cap and trade vs carbon tax ontario

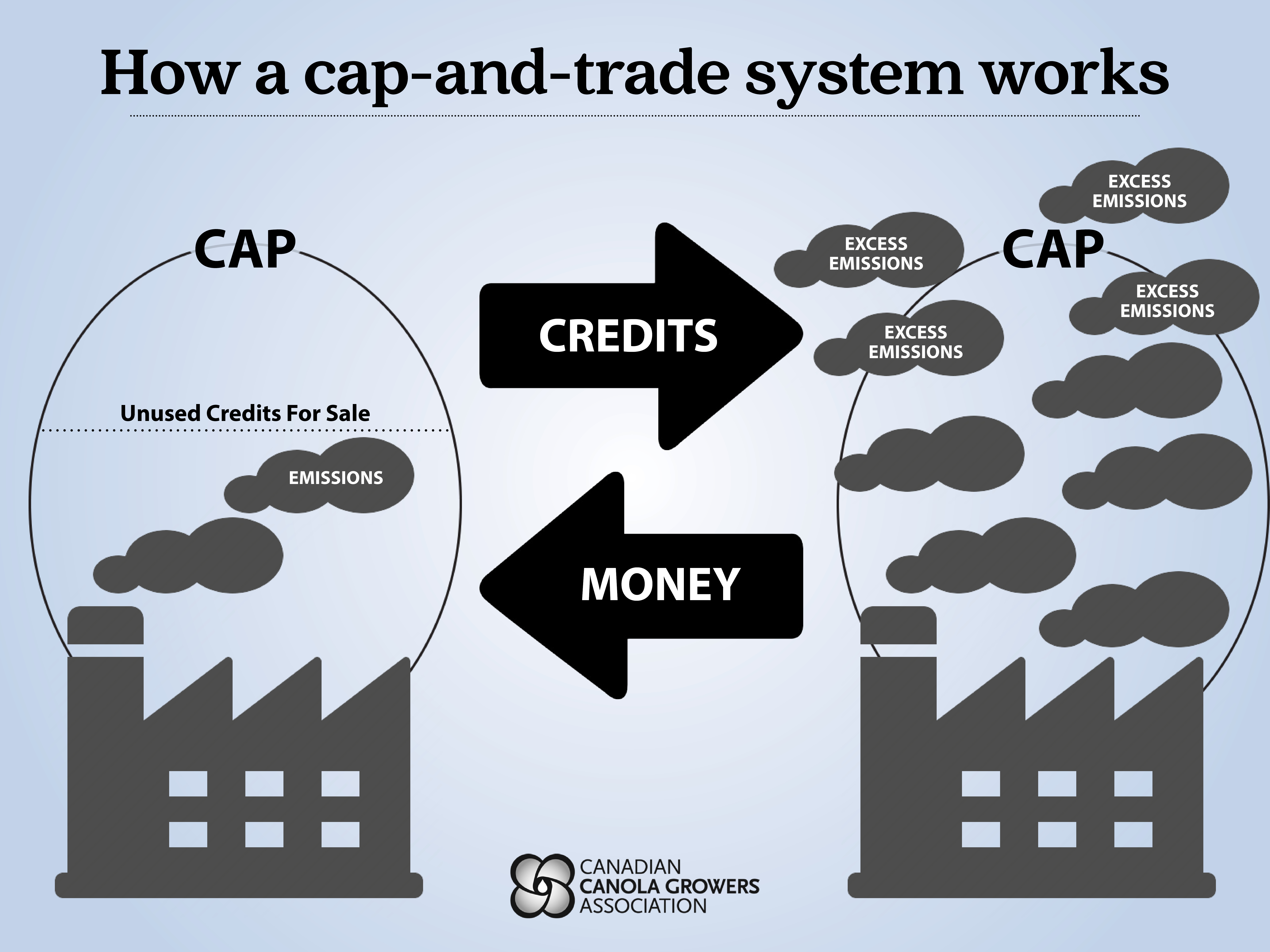

In certain idealized circumstances carbon taxes and cap-and-trade have exactly the same outcomes since they are both ways to price carbon. Indeed both cap-and-trade and carbon taxes are good approaches to the problem.

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

TORONTO Doug Ford said Friday he will scrap Ontarios cap-and-trade system and fight a federal carbon tax as soon as his Progressive Conservative cabinet is sworn in later this month because.

. While there are trade-offs between. They have many similarities some trade-offs and a few key differences. The increase will also.

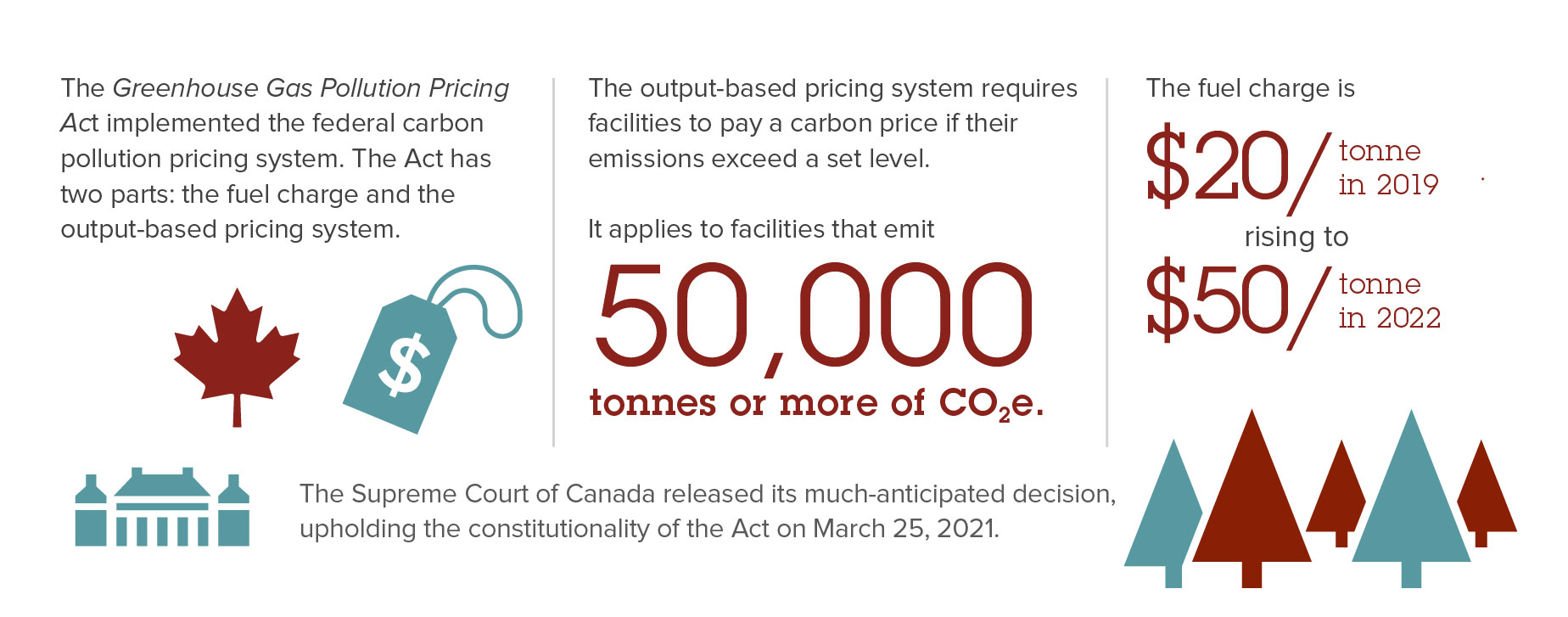

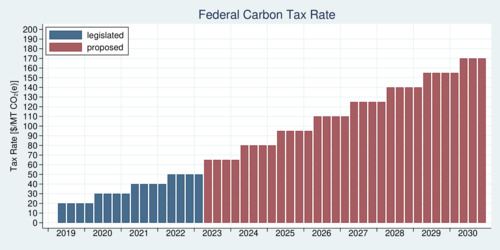

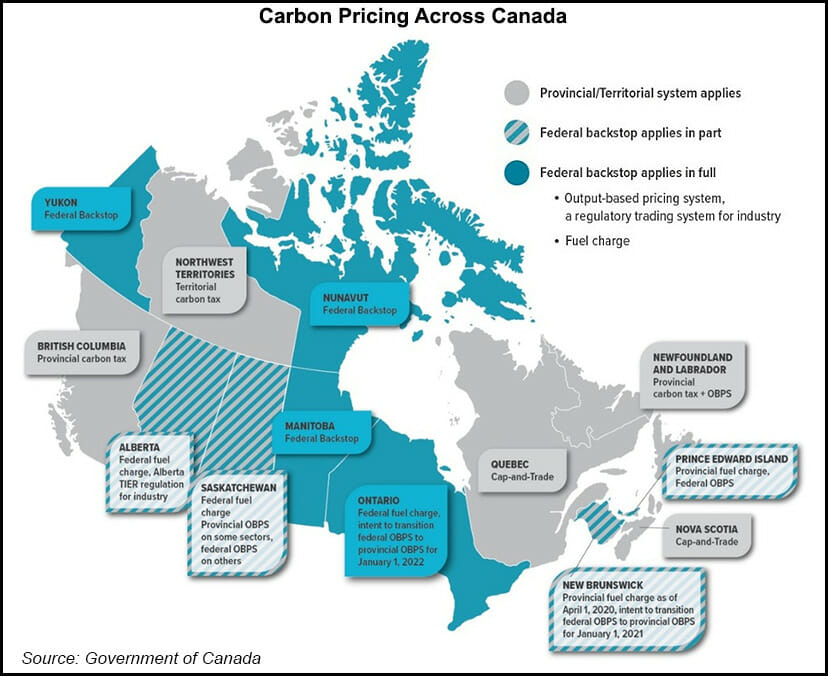

The COPS21 conference is aiming to limit the rise in carbon to 450 particles per million ppm and to cap the rise in temperature to 2 degrees Celsius above pre-industrial levels by the end of the. On October 31 Ontario passed the Cap and Trade Cancellation Act 2018 that officially removed Ontarios cap and trade program law from the books. On April 1 2022 the federal carbon tax will go up another 10 per tonne up to a total of 50 per tonne of emissions.

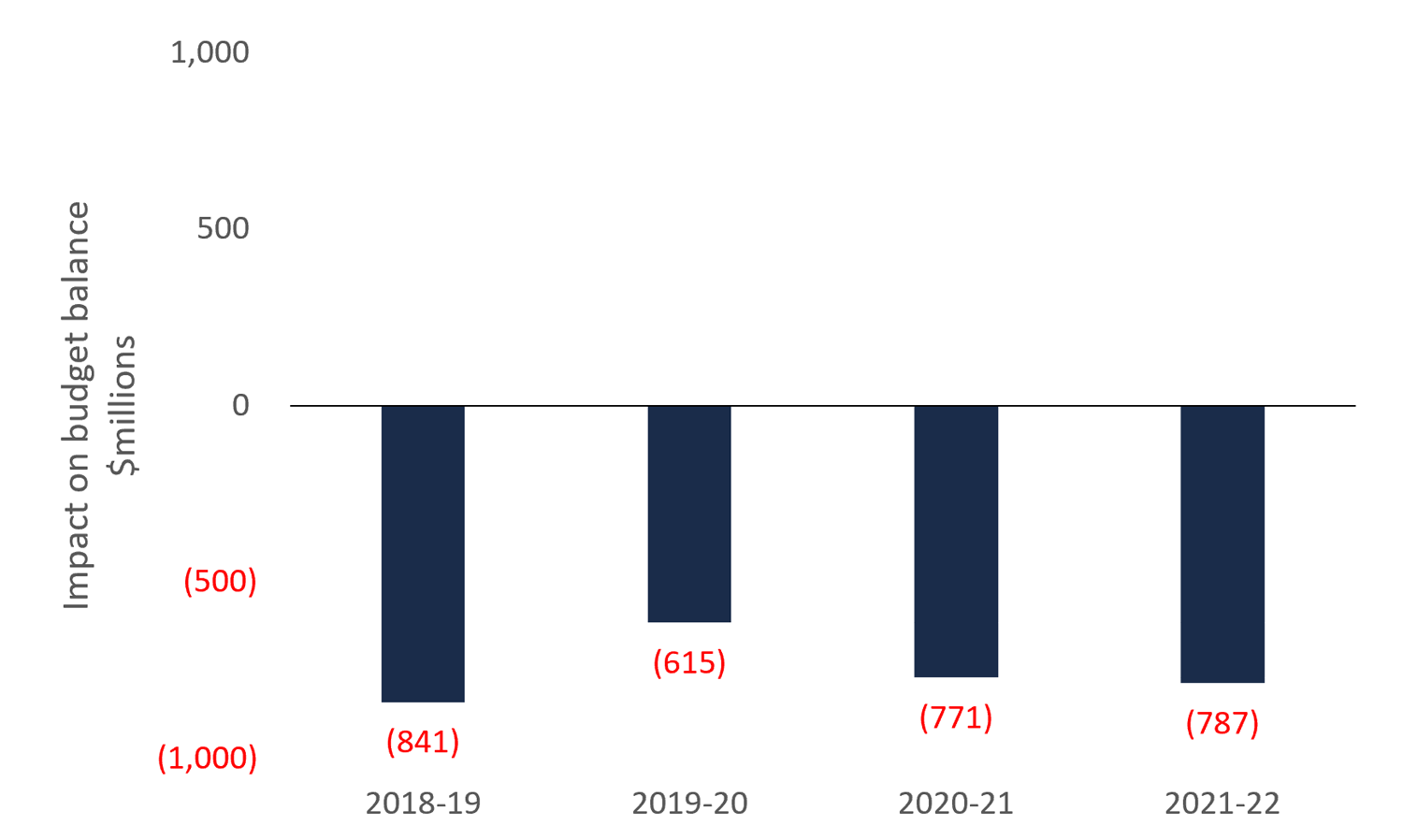

I am opposed however to the confused and mislead-ing straw-man arguments that have sometimes been used against cap-and-trade. A carbon tax and cap-and-trade are opposite sides of the same coin. The government has finalized the compensation for the eligible participants of the former program which amounts to a total of 5090000.

What you need to know about Ontarios carbon market using a cap and trade program including how it works and who is required to participate. 54 International credits were allowed during the first few months of the carbon-taxs operation. Critics blast government spending on court battle against federal carbon tax Ontarios cap-and-trade system aimed to lower greenhouse gas emissions by putting caps on the amount of pollution.

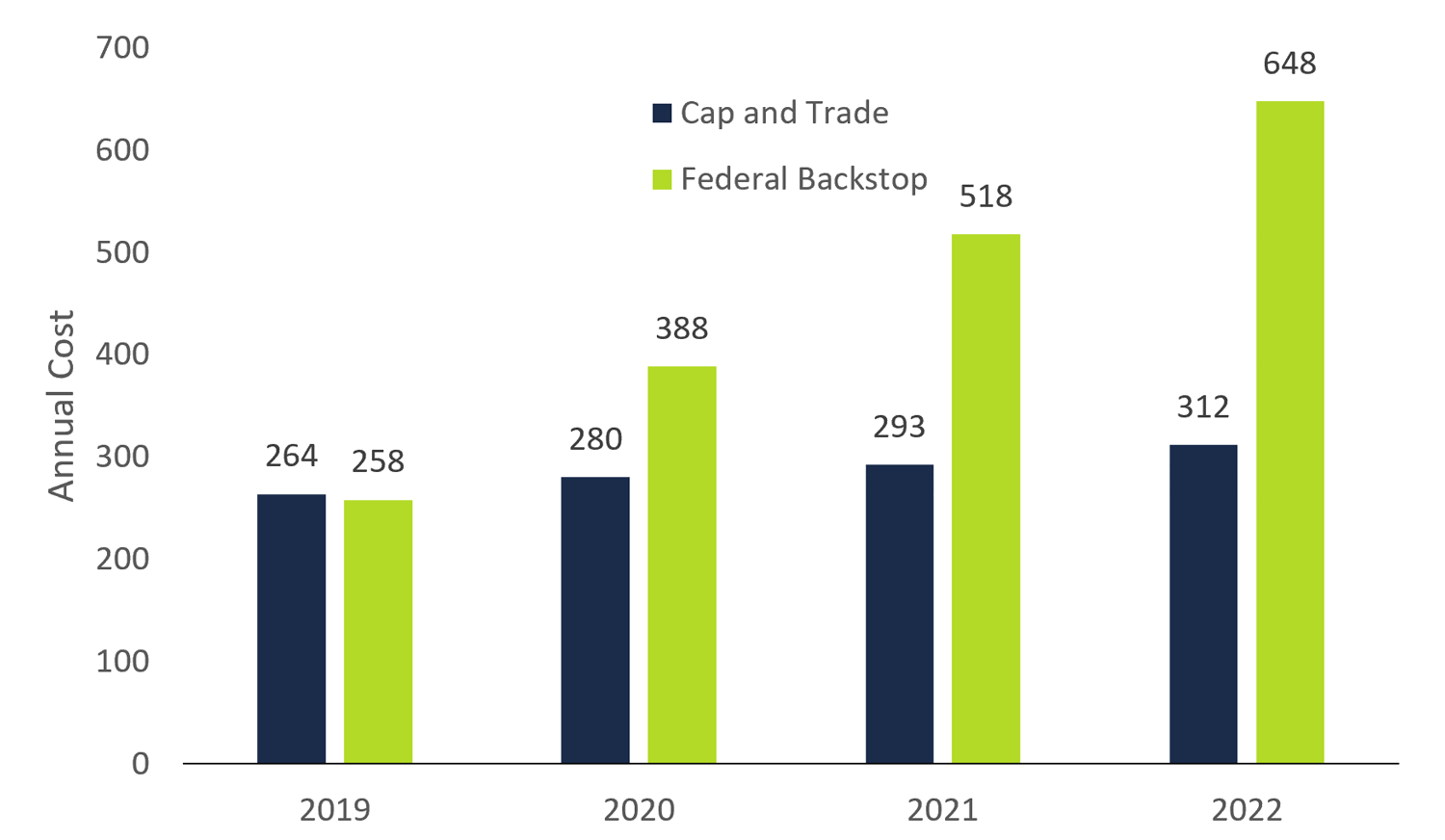

This is the federal law Progressive Conservative Leader Patrick Brown said in an interview. The federal carbon tax will cost a typical household 258year in 2019 and will rise to 648 by 2022. The carbon-tax law provided for fossil fuels not subject to existing taxes fuel oil coke and.

The orderly wind down of the cap-and-trade carbon tax is a key step towards fulfilling the governments commitment to reducing gas prices by 10 cents per litre. The elimination of the cap and trade carbon tax will reduce gas prices save the average family 260 per year and remove a costly burden from Ontario businesses allowing. A carbon tax sets the price of carbon dioxide emissions and allows the market to determine the quantity of emission reductions.

The total compensation amount is 5090000 for a total of 27 participants. Under the federal governments carbon tax favoured by the PCs Ottawa has said provinces must choose between cap and trade and a carbon tax the price would be 50 a tonne by 2022. Today Ontarios Government for the People delivered on a promise to make life more affordable for families through the passage of Bill 4 The Cap and Trade Cancellation Act.

Ontarios government is working for the people in taking the final step to end the cap and trade carbon tax once and for all in a way that puts people first and respects Ontario taxpayers. Both a carbon tax and a cap-and-trade system would result in higher energy costs to consumers. Learn the basics of cap and trade Effective July 3 2018 we cancelled the cap and trade regulation and prohibited all trading of emission allowances.

In addition to saving families money the elimination of the cap-and-trade carbon tax will remove a cost burden from Ontario businesses allowing them to grow create jobs and compete around the world. We have developed a plan to wind down the program. Mineral carbon to be taxed beginning in January 2019 at 10 of the rate for other fuels.

Over the five-year period a carbon tax would achieve 29 megatonnes more in Ontario emissions reductions than the current cap and trade system. Carbon tax approaches however can be designed such that tax revenues are returned.

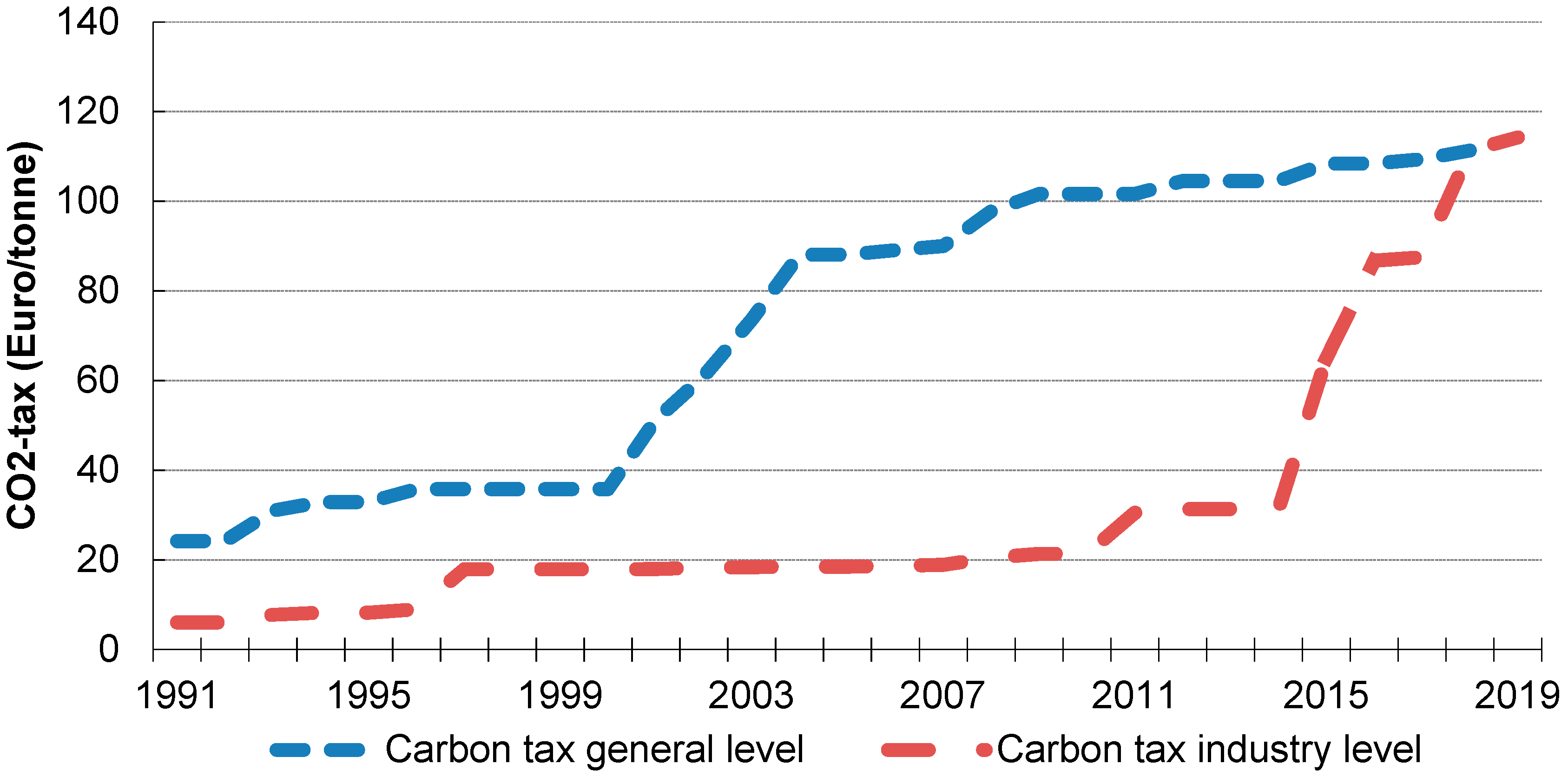

Sustainability Free Full Text Carbon Taxation A Tale Of Three Countries Html

Carbon Taxes And Cap And Trade State Policy Options Muninet Guide

Federal Government S Carbon And Greenhouse Gas Legislation Canada

The Carbon Market A Green Economy Growth Tool

Economist S View Carbon Taxes Vs Cap And Trade

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Carbon Markets Putting A Price On Carbon Green City Times

Canada S Carbon Pricing Is Continuing On The Right Track

Lowdown On The New Federal Carbon Pricing System

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

Nova Scotia S Cap And Trade Program Climate Change Nova Scotia

Cap And Trade A Financial Review Of The Decision To Cancel The Cap And Trade Program

Canada S Scheduled Carbon Tax Increases Said To Pose Implementation Risk Natural Gas Intelligence

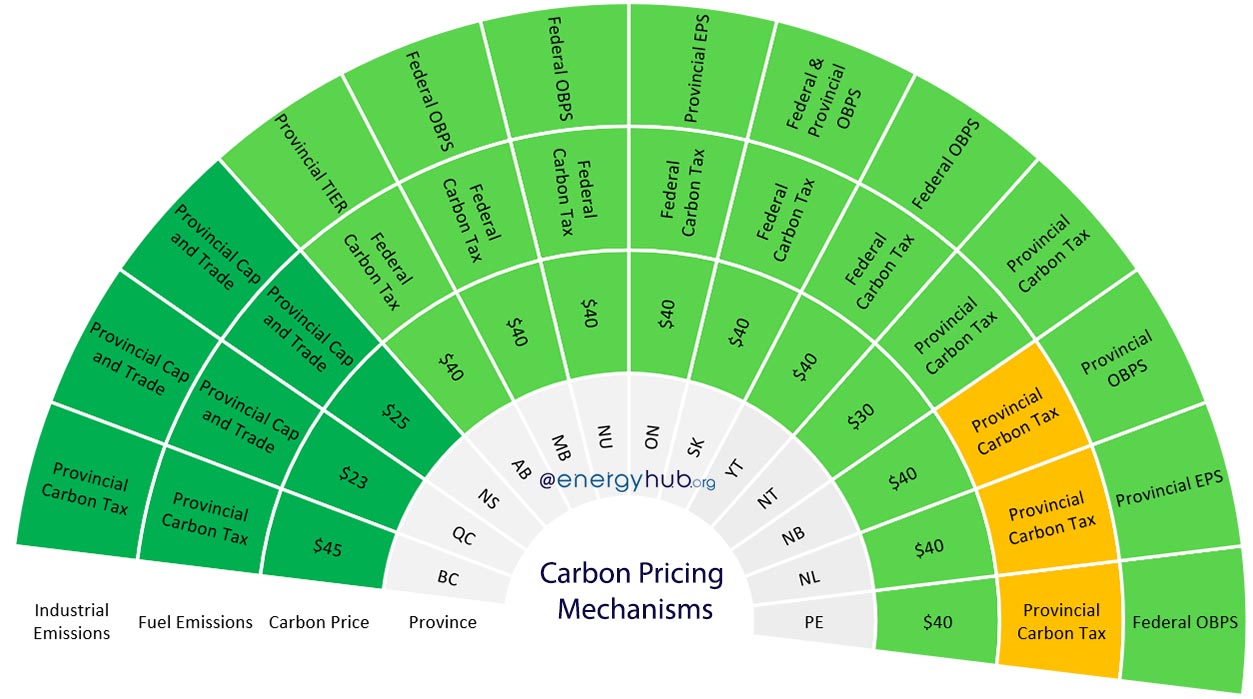

Your Cheat Sheet To Carbon Pricing In Canada Delphi Group

The Pros And Cons Of Carbon Taxes And Cap And Trade Systems Semantic Scholar

What Is Carbon Pricing Canadian Canola Growers Association

Carbon Pricing Is Here To Stay In Canada What Is It Anyway Youtube

Canadian Carbon Prices Rebates Updated 2021

Estimated Impacts Of The Federal Carbon Pollution Pricing System Canada Ca